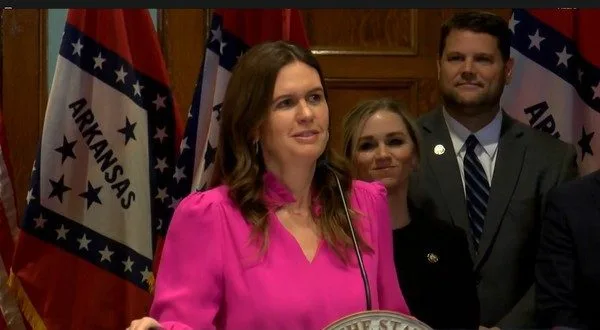

Arkansas Governor Sarah Huckabee Sanders unveiled two new legislative measures on Tuesday designed to provide financial relief for families and bolster food security efforts in the state.

The first measure, known as the Grocery Tax Relief Act, seeks to eliminate the state sales tax on food ingredients, a move expected to return nearly $10.9 million annually to Arkansas taxpayers. The legislation, however, does not affect local county or municipal taxes on groceries.

The second piece of legislation, the Good Neighbor Act, is aimed at encouraging food donations by extending liability protections to a broad range of donors. This includes grocery retailers, wholesalers, restaurants, caterers, farmers, and various nonprofit organizations, as well as food banks that distribute donated goods.

These new bills are seen as steps toward reducing the financial strain on families and fostering a culture of generosity in the state, according to Sanders, who emphasized the importance of both acts in addressing the needs of Arkansans.

This announcement follows Sanders’ recent signature of a bill to provide free school breakfasts and her confirmation in November that the state’s Summer EBT program will continue into 2025, building on the success of the previous year when the program assisted over 260,000 children.

The Grocery Tax Relief Act was sponsored by Senate President Pro Tempore Bart Hester and Rep. Ken Underwood, both of Cave Springs, while the Good Neighbor Act was championed by Sen. Breanne Davis of Russellville and Rep. Chad Puryear of Hindsville.

WebReadyTM Powered by WireReady® NSI